JUNE 2024 SAN DIEGO REAL ESTATE MARKET

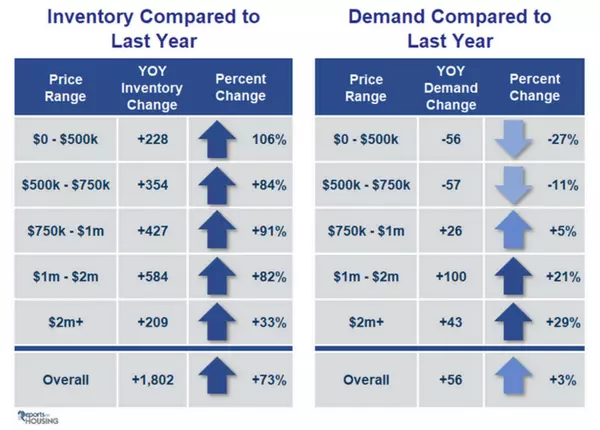

OPEN HOUSES ARE BACK! San Diego Real Estate Market, June 2024 The active listing inventory increased and now sits at 4,259, matching its largest rise of the year. It is the first time the inventory has surpassed 4,000 homes since November 2022. Last year, the inventory was 2,457 homes, 42% lower,

San Diego Housing Inventory & Interest rates April 2024

April San Diego Real Estate Market Update In March, 41% fewer homes came on the market compared to the 3-year average before COVID (2017 to 2019), 2,023 fewer. Last year, there were 2,101 homes on the market, 651 fewer homes, or 24% less. The 3-year average before COVID (2017 to 2019) was 5,846, or

Who will pay Buyer's Commissions? $418 million NAR Settlement Agreement

On March 15, 2024, The National Association of REALTORS® (NAR) reached an agreement that would end litigation of claims brought of sellers related to broker commissions. Under the terms of the agreement, NAR would pay $418 million over approximately four years. Key Points of the Agreement: MLS wil

Categories

Recent Posts

![Things To Do On Halloween in San Diego [2025]](https://img.chime.me/image/fs/chimeblog/289037000021392/34982/20251001/16/w600_original_28076fb5-93ce-4e7d-a078-55da51e5d4b0-jpg.webp)